Business Insurance in and around West Jordan

Calling all small business owners of West Jordan!

Insure your business, intentionally

This Coverage Is Worth It.

When you're a business owner, there's so much to take into account. It's understandable. State Farm agent Vincent Campo is a business owner, too. Let Vincent Campo help you make sure that your business is properly insured. You won't regret it!

Calling all small business owners of West Jordan!

Insure your business, intentionally

Customizable Coverage For Your Business

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a piano tuner or an optician or you own a camera store or a shoe store. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Vincent Campo. Vincent Campo is the agent who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to learn more about your small business insurance options

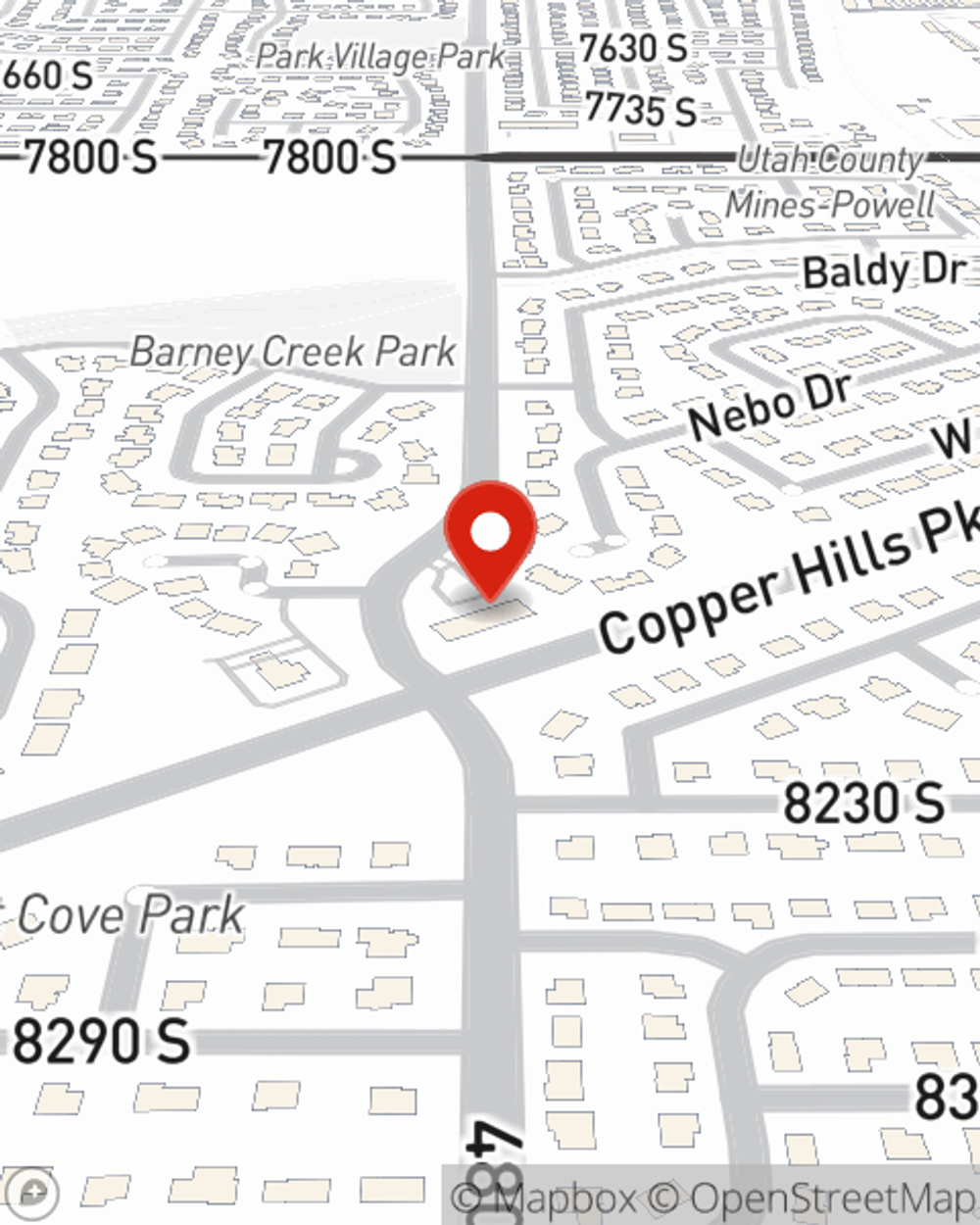

Get in touch with State Farm agent Vincent Campo today to explore how a State Farm small business policy can safeguard your future here in West Jordan, UT.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Vincent Campo

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.